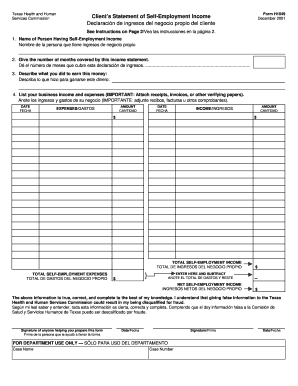

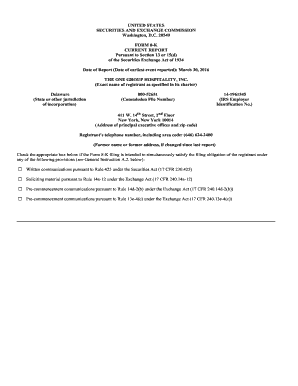

TX H1049 2007-2024 free printable template

Get, Create, Make and Sign

Editing 1049 form online

TX H1049 Form Versions

How to fill out 1049 form 2007-2024

How to fill out t h1049 rev 12:

Who needs t h1049 rev 12:

Video instructions and help with filling out and completing 1049 form

Instructions and Help about h1049 form

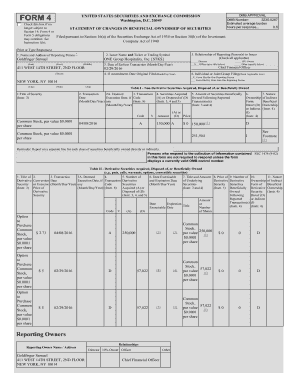

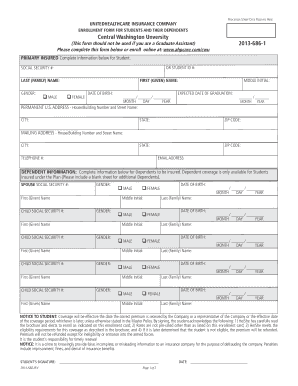

Hi this is Evan Hutches on, and I'm going to go over the basic 1040 tax return I will just kind of go over a grand overview of these two pages of this 1040 I'm not going to go over the other schedules and forms this is the form that everything flows into so no matter what you're going to have to file a Form 1040 if you're filing US income tax return you might not have to file any more schedules or forms but everything that you do file flows into this form right here, so it's two pages long as I said this is kind of what it looks like and the final numbers are right here you're either going to get a refund or you're going to owe and that's what all this is about so if we start at the top we'll put your name John Doe and your social right here John Doe does not have a spouse he located at one Two three Main Street he has no dependents if you had a spouse oh go right here if you had dependent ill we go right here and that would increase his exemptions, so it's just him, so it says one personal exemption, and we'll get to that in just a second the next portion of the return is the income portion now there are many kinds of income that needs to be reported on your income tax return one of the main ones and one of the ones that most a lot of people are only familiar with or is the w2 income some people just get a w-2, and they're used to just filing it and getting a refund because usually there's enough federal income tax being withheld to cover their wages now if you have a w-2 Box one would go right here and your federal income tax withholding, so I think it's box three would go down here on page two federal income tax withheld from forms w2 right here then you have taxable interest tax-exempt interest some interest is not taxable by the federal government if it's not taxable it would go in line 8 B if it is taxable or whether is taxable actually it'll go on a day but if it is, I'm sorry if it is taxable to go on a day if it's not taxable to go on 8 B same thing with dividends you have to pay taxes on the dividends that you earn if you have qualified dividends they get a preferential tax rate of either 0 percent or 15 percent depending on your normal tax rate your qualified dividends would go right there on line 9 B, but they would also go on line 9 a some other sources I'll just kind of hit the main ones to my knowledge at least the ones that I run into the most alimony received if you get alimony it is taxable if you pay out alimony its text deductible so if you pay it out it, you could put it right here and of course they're going to want who you pay it to social security number, so they can look at that person's return and make sure they're claiming it is income right here business income would go right here this is if you're a single member LLC or a sole proprietor you would put your earnings and your deductions on Schedule C which flows to this line 12 of the 1040 now if you do have Schedule C income or if you have partnership and come down...

Fill form 1049 pdf : Try Risk Free

People Also Ask about 1049 form

Our user reviews speak for themselves

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Fill out your 1049 form 2007-2024 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.