TX H1049 2007-2026 free printable template

Show details

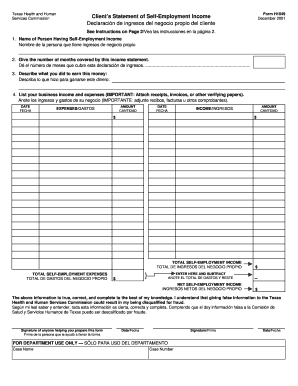

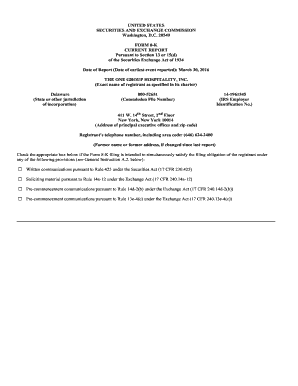

Texas Health and Human Services Commission Self-Employment Income Worksheet Form H1049 Page 3/07-2004 For Department Use Only/El Departamento Llena Esta Hoja Name of Self-Employed Person I. E. Monthly self-employment income divide Line C by Line D. II. Computation of Monthly Self-Employment Income Total monthly self-employment income non-farm Add all selfemployment income from Form H1049 Step I Line E.. Computation of Monthly Self-Employment Income Annual or Seasonal A. Gross income from...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign h1049 form

Edit your form 1049 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 1049 form self employment form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing t h1049 rev 12 2015 1 spa online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Log into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit 1049 form. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

TX H1049 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out texas health and human services form 1049

How to fill out TX H1049

01

Gather necessary personal and financial documents, including your income statements, tax documents, and any relevant identification.

02

Download the TX H1049 form from the official Texas Health and Human Services website or obtain a paper copy.

03

Begin filling out section one by providing your personal information such as name, address, and date of birth.

04

In section two, report your household income and any other relevant financial information as directed.

05

Complete section three concerning any medical expenses, if applicable.

06

Review all entered information for accuracy and completeness.

07

Sign and date the form at the designated spot to validate your application.

08

Submit the form either electronically through the Texas Health and Human Services system or mail it to the appropriate processing center.

Who needs TX H1049?

01

Individuals or families in Texas who are applying for benefits related to health and nutrition assistance programs.

02

Those who have experienced significant changes in their financial situation that may affect their eligibility for state assistance.

Fill

form 1049 client's statement of self employment

: Try Risk Free

People Also Ask about form h1049

How do I prove self employment income to the IRS?

Self-employed persons, including direct sellers, report their income on Schedule C (Form 1040), Profit or Loss from Business (Sole Proprietorship). Use Schedule SE (Form 1040), Self-Employment Tax if the net earnings from self-employment are $400 or more.

How do I file a 1040EZ form?

How to Fill Out a US 1040EZ Tax Return 1 Determining if You Can Use the Form 1040EZ and Gathering Materials. 2 Completing the Top Section. 3 Completing the Income Section. 4 Completing the Payments, Credits and Tax Section. 5 Calculating Your Refund or the Amount You Owe. 6 Finishing and Filing Your Return.

How to fill out Form 1049?

1049 Self Employment Form: List your Hours Worked, Income Earned & Work Expenses for the past three months. Add the amounts for each column and complete the TOTAL at the bottom of the page. Subtract your expenses from your total self-employment income and enter your Net Self-Employment Income.

Can I fill out a 1040 form online?

Yes, you can file an original Form 1040 series tax return electronically using any filing status. Filing your return electronically is faster, safer, and more accurate than mailing your tax return because it's transmitted electronically to the IRS computer systems.

How to fill out a 1040 form?

0:46 11:47 How to Fill Out Form 1040 for 2022 | Taxes 2023 | Money Instructor YouTube Start of suggested clip End of suggested clip Finally you will determine your tax bill or refund. This will tell you whether you have already paidMoreFinally you will determine your tax bill or refund. This will tell you whether you have already paid any or all of your tax bill and whether you are eligible for a refund if you have overpaid.

How do I assemble my 1040 tax return?

When assembling your tax return, place the forms in order of their sequence, with Form 1040 (or 1040A) on top. If you have any supporting statements or schedules, attach them all at the end, in the same order as the forms or schedules they refer to.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in h1049 self without leaving Chrome?

Get and add pdfFiller Google Chrome Extension to your browser to edit, fill out and eSign your pdffiller, which you can open in the editor directly from a Google search page in just one click. Execute your fillable documents from any internet-connected device without leaving Chrome.

Can I create an electronic signature for signing my form 1049 pdf in Gmail?

With pdfFiller's add-on, you may upload, type, or draw a signature in Gmail. You can eSign your form 1049 your texas benefits and other papers directly in your mailbox with pdfFiller. To preserve signed papers and your personal signatures, create an account.

How do I edit h1049 straight from my smartphone?

The easiest way to edit documents on a mobile device is using pdfFiller’s mobile-native apps for iOS and Android. You can download those from the Apple Store and Google Play, respectively. You can learn more about the apps here. Install and log in to the application to start editing form h1049 pdf.

What is TX H1049?

TX H1049 is a form used in Texas for reporting various tax-related information, specifically concerning sales and use tax.

Who is required to file TX H1049?

Businesses and individuals who engage in sales or services subject to sales and use tax in Texas are required to file TX H1049.

How to fill out TX H1049?

To fill out TX H1049, gather all relevant sales and tax information, complete each section of the form accurately, and ensure all required signatures are included before submitting.

What is the purpose of TX H1049?

The purpose of TX H1049 is to report sales tax collected and due to the state, and to ensure compliance with Texas tax laws.

What information must be reported on TX H1049?

TX H1049 must include information such as total sales, taxable and exempt sales, sales tax collected, and information about the business or individual filing the report.

Fill out your TX H1049 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form h1049 Texas is not the form you're looking for?Search for another form here.

Keywords relevant to form 1049 texas benefits

Related to form h1049 client print

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.